LEARN DAY TRADING FROM PRO TRADERS

Our Forex Trading service provides education as well as One on One Forex Mentor services. Our goal is to provide a complete training experience to prepare our members for a career in Forex. Our membership consists of a wide range of talents from beginners, to experienced Forex money managers.

We provide a Live Forex Trading Room to teach Forex.

Our Forex Trading Room provides a great opportunity to see live trades get executed and learn in real time. We offer various plans to meet your goals.

WHY OUR FOREX TRADING ROOM ?

We are not your average trading room, and since 2010 have led the path in Forex Education. Here are some key reasons why our service continues to be the choice of many newbie as well as seasoned professionals.

-

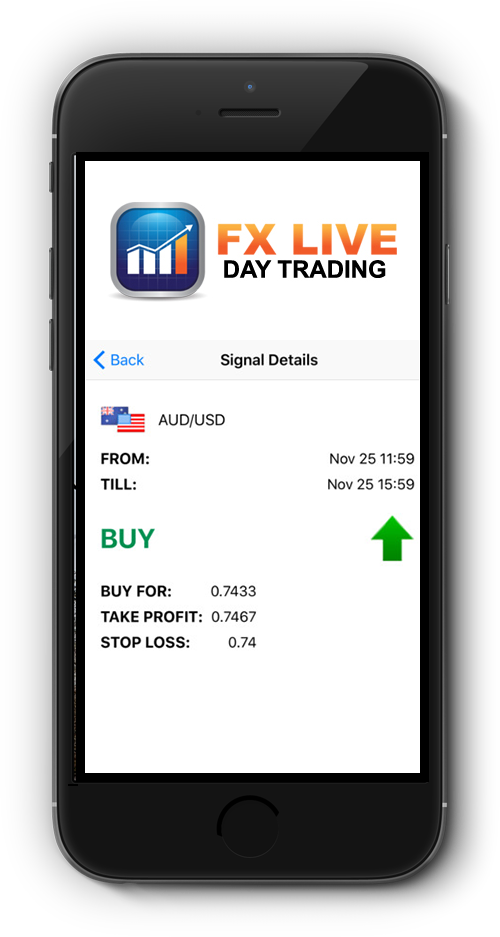

Forex Trading App.

Our proprietary App provides access to our Forex Trading Room directly to your smart phone. Streaming video, audio, as well as news sent in real time. A Forex Trading Signals are an optional service available.

-

Trade Setups

Access real time trade setups from various different pairs.

-

Market Analysis

Receive market analysis live from an expert trader. Questions will be answered as we explain reasons for taking each trade.

-

Mentorship

Gain the edge by having your very own trading mentor. We feel our mentorship can potentially save thousands of dollars for our students since 95% of traders lose money.

-

Forex News

Receive real time news feedback and trading ideas to help you trade.

-

Watch Results

Watch results and duplicate as you wish, there is no pressure to take trades and we understand everyone has a different style.

Forex Trading Signals

All Live Trading Room memberships include a free Forex Signals standard subscription.

-

SMS + Email Alerts

We send our Trading Signals by SMS and Email. Alerts include Buy/Sell Entry Points, Stop Loss and Take Profit levels.

-

24/5 Trade Signals

We monitor the Fx markets 24 hours a day seeking excellent BUY and SELL trade opportunities.

-

Multiple Pairs

Trading signals and market analysis are performed for pairs we deem to have reasonable spreads as well as good chart setups. Pairs we trade are: GBPUSD, EURUSD, USDJPY, AUDUSD, USDCAD, EURJPY

-

Forex Signal Platform

Access our easy to use Forex signal platform on your phone, tablet or computer.

-

Clear Detailed Signals

All our FX signals include Entry, stop loss and take profit targets. Signals will be limit orders or market orders.

-

Trade Copier

Our Pro plan includes a Forex Trade Copier is great for those who are not able to trade or simply prefer to have the signals automated.

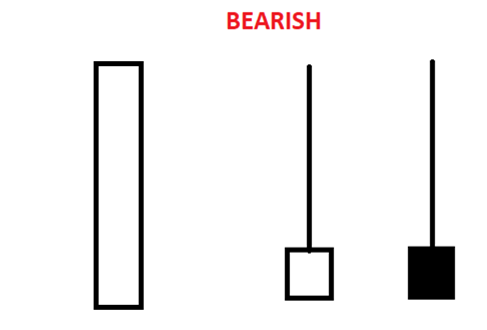

Pro Forex Technical Analysis

In our trading room we provide professional technical analysis. Our partners have a combined experience of over 25 years of trading full time.