Reversal Day Trading Strategies

An Introduction To The Reversal Bar Forex Trading Strategy...

The reversal candle formation is a price reversal candle pattern that tells us that there is a specific resistance or support of interest where markets have stopped and reversed. Once you become familiar with this simple candle reversal formation, the more you study this pattern the more apparent you will discover how profitable this can be.

What is a Reversal Candle?

The actual reversal candle is very easy to spot and has a body with a long "wick". We use them because they show the price action the clearest and are the most popular charts amongst professional traders. Some traders may not use candlesticks and use "bar charts", however, I use them since they are easier to spot in my opinion.

Spotting a Reverse Candle Formation

• The reversal candlestick bar should have a long upper or lower wick or "tail".

• The open and close of the reversal candle bar are near one end of the bar, the closer to the end the better.

• The shadow or tail of the candlestick size (the larger the better, yes size matters here).

• A general “rule of thumb” is that you want to see the pin bar tail be two/thirds the total pin bar length or more and the rest of the pin bar should be one/third the total pin bar length or le

• The area between the open and close of the pin bar is called the “body” or “real body”. Depending on your settings on your candlestick will depend on the color that will show on your chart.

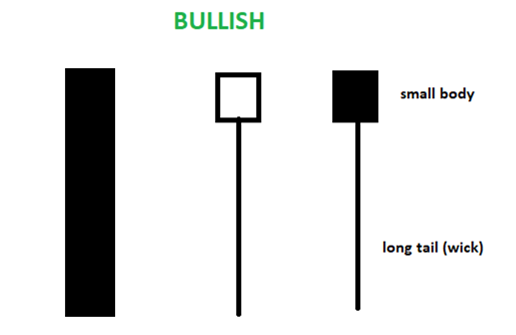

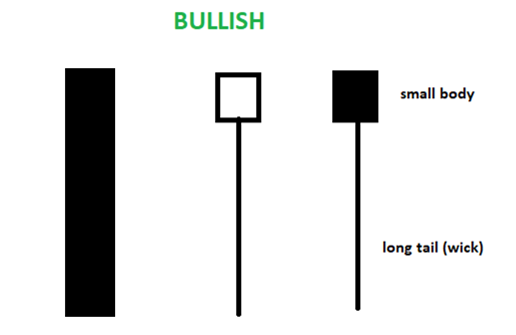

Bullish Reversal Candlestick Formation

In a bullish candlestick reversal setup, the pin bar’s tail points down because it shows rejection of lower prices or a level of support.

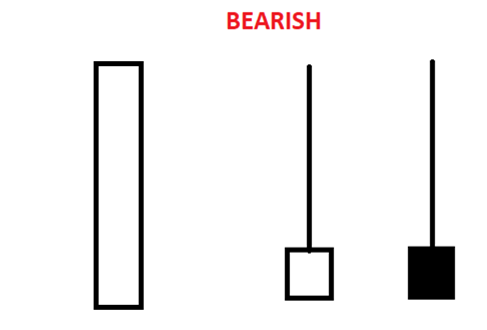

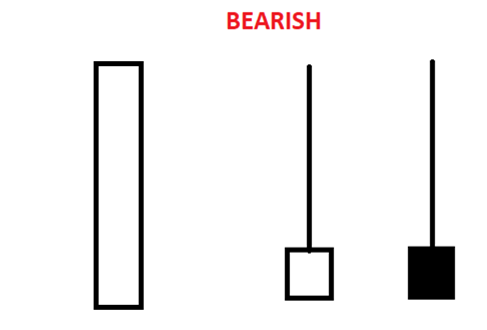

Bearish Reversal Candlestick Formation

In a bearish candlestick reversal setup, the reversal tail points up because it shows rejection of higher prices or a level of resistance. This setup very often leads to a drop in price.

- Posted by fx_Trader

- On August 10, 2021

- 0 Comments

0 Comments