Daily Forex Trading Review for Friday 9-11-2015

Daily Forex Trading Review

9-11-2015

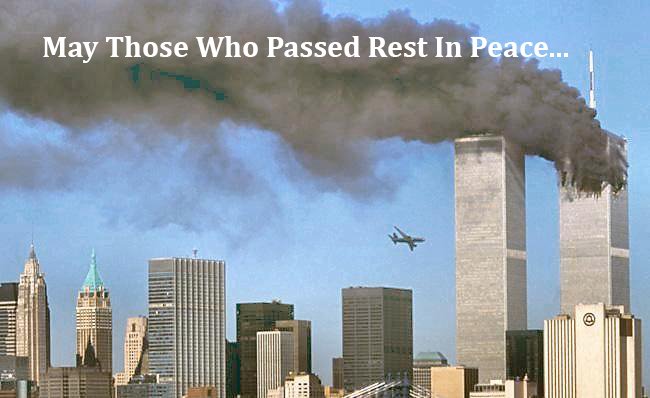

I can't help mentioning 9-11 as I write this short article. On 9-11-2001 I was working on Wall Street, and I remember the sad day it was. I still sometimes worry about the health issues that many have experienced since that day (Cancer etc..). On 9-11. I decided to go into my office located 1 block from Wall Street a little later. I ended up going for a jog in Brooklyn where I lived. When I came back from the Jog, I heard a loud explosion and I saw it from my apartment window. Sad day it was, I am happy I was not at work, however I am very sad for all those who were...May those who pass rest in peace....

Daily Forex Trading Summary:

As expected London session was light, given the fact that Friday seems to produce these type of days. Later will be the MPC member speech however I don't expect this to be significant to move markets. Later we have US PPI. I may be taking a trade on the YEN later if the opportunity shows itself at our key trading room levels.

Daily Forex Market Sentiment Ideas:

We have seen the last few session as light in volume as markets calm down from some previous weeks of volatility. We have seen a significant amount of data released, however unlike 2 or 3 weeks ago moves have been more conservative.

One mover this week was the AUD, this pair got a jolt of buyers after the good jobs report, pushed their RBA rate cut expectations into 2016.

BOJ and The Yen

We had some news this week from Abe adviser, Yamamoto, that the BOJ needs to ease further. He hinted at further stimulus measures to take place. We have a BOJ meeting, release of statement and press conference next Tuesday. We often see the BOJ with surprise moves, so I don't take this news serious, in fact a move down in stocks will further strengthen stocks and move the Yen higher.

Next week we have the FOMC rate decision, some still expect an increase in rates, so we will see what happens. The market has continued to scale back its expectations of September liftoff, which are now at about 25% probability. We have seen some USD weakness in the last week based on this probability.

- Posted by fx_Trader

- On September 11, 2015

- 0 Comments

0 Comments